Should You Sell First or Buy First?

A Simple Decision Matrix to Use Now

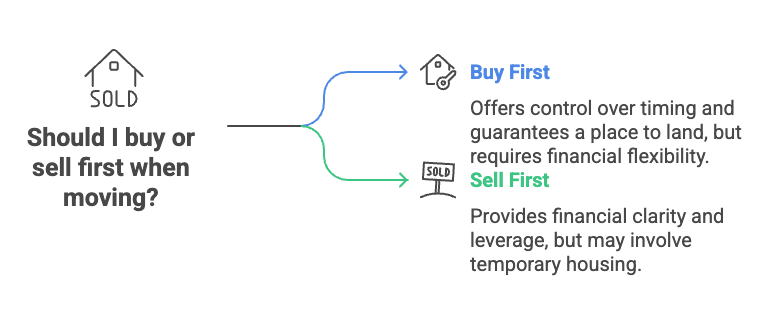

If you’re a homeowner planning a move, there’s one question that always seems to spark debate:

👉 Should you sell your current home first, or buy your next one before putting the old one on the market?

It’s a big decision—one that affects your finances, your stress level, and even your family’s daily life.

The truth is, there’s no “right” or “wrong” answer. But there is a right answer for you—and with the right framework, you can find it.

Why This Decision Matters

Your home isn’t just four walls and a roof—it’s your financial anchor and your family’s comfort zone. Timing when to sell and when to buy impacts:

- Your budget. How much you can spend on the new home depends, in part, on what you net from selling the old one.

- Your stress level. The order of operations determines whether you move once or twice, whether you face overlap costs, and how smooth (or chaotic) the transition feels.

- Your family’s daily rhythm. Nobody loves the thought of temporary housing, storage units, or feeling “in between homes.”

That’s why this decision deserves some thoughtful planning.

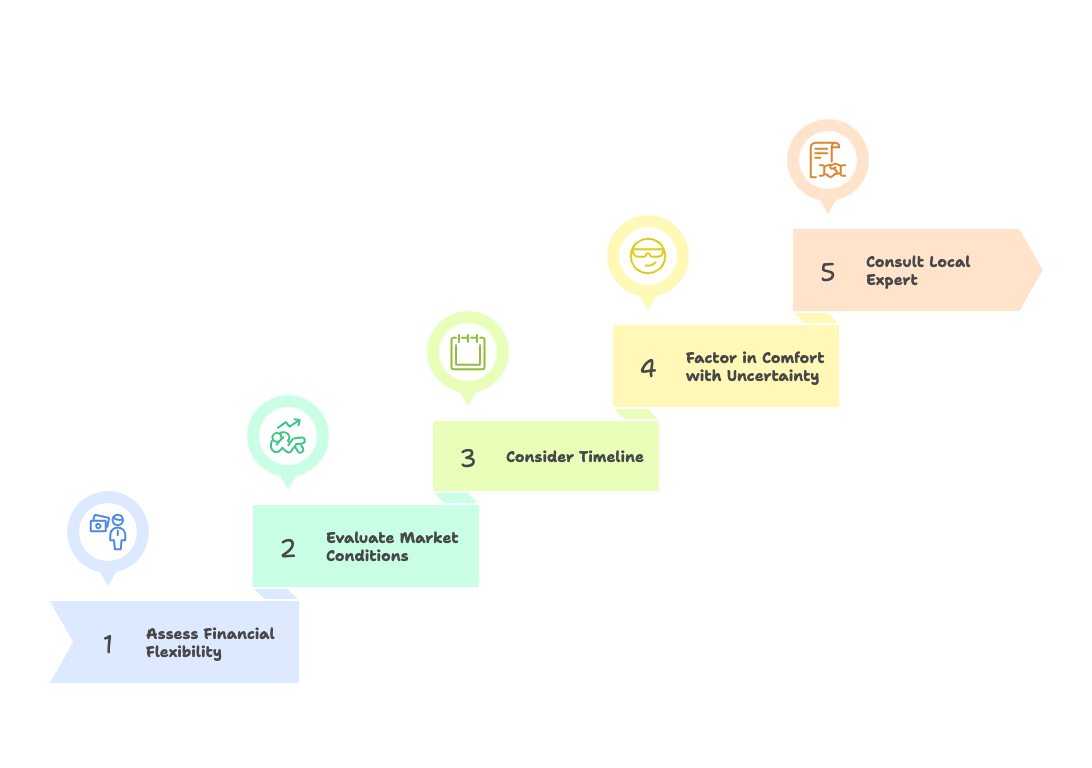

The Step-by-Step Decision Matrix

Use these five steps as your filter for clarity:

Step 1: Assess Your Financial Flexibility

Can you comfortably carry two mortgages if needed—even for a short period?

- If yes, buying first may give you more control over timing.

- If no, selling first may be the safer route.

Step 2: Evaluate the Market

This is where many homeowners get tripped up, because the terms “buyer’s market” and “seller’s market” can feel abstract. But here’s how they actually affect your decision.

🔹 In a Seller’s Market (homes sell quickly)

- Buyers are competing for fewer homes.

- Well-priced listings often sell in days, sometimes with multiple offers.

👉 What this means for you: If you own a home in a strong seller’s market, you’ll likely sell it quickly once you list it. That gives you more confidence to buy first, knowing your current home won’t sit unsold for long. The risk of carrying two mortgages is lower because demand is high.

Example: If homes in your neighborhood are selling in less than 2 weeks with multiple offers, you might choose to secure your next home first, then list your current one—because odds are, it will move fast.

🔹 In a Buyer’s Market (homes take longer to sell)

- There are more homes available than buyers looking.

- Listings may sit on the market for weeks or months.

- Buyers often have the leverage to negotiate lower prices.

👉 What this means for you: If you own a home in a buyer’s market, selling could take longer. In this scenario, selling first may give you more financial clarity and prevent the stress of carrying two mortgages while waiting for your home to sell.

Example: If the average days-on-market in your area is 60–90 days, buying first could leave you with two mortgages for months. Selling first ensures you know exactly what you have to work with before committing to your next home.

💡 The bottom line:

- In a seller’s market, buying first can be less risky because your old home will likely sell quickly.

- In a buyer’s market, selling first is safer because it may take longer to find the right buyer for your current home.

Step 3: Consider Your Timeline

Do you have an urgent reason to move (a new job, school district change, family needs)?

- If yes, buying first can guarantee you a place to land.

- If no, selling first may give you more financial clarity.

Step 4: Factor in Your Comfort With Uncertainty

How do you feel about the idea of temporary housing, storage, or a gap between closings?

- If you’re flexible, selling first may work fine.

- If you’re not okay with disruption, buying first may save you stress.

Step 5: Talk to a Local Expert

This is the step that ties everything together. A local agent can tell you how long homes like yours typically stay on the market, how quickly new listings are moving, and whether bridge loans or contingent offers are common in your area.

Real-Life Examples

I’ve worked with clients who sold first—and loved the peace of mind of knowing exactly what they could spend. It allowed them to shop with confidence.

I’ve also worked with clients who bought first—because the thought of moving twice (into temporary housing, then into their new home) felt overwhelming. For them, carrying two mortgages for a short time was worth it to avoid that stress.

Both choices were right—because they were aligned with those families’ needs, finances, and personalities.

My Best Advice

- Know yourself. Some people lose sleep over financial uncertainty; others lose sleep over logistical stress. Which are you more willing to carry?

- Have a backup plan. Even with the best timing, things can shift. A short-term rental, storage option, or bridge loan can keep you from panicking.

- Don’t decide in a vacuum. Lean on professionals who understand the market right now—because what’s smart in one season might not be in another.

Final Thought

There’s no universal answer to the “sell first or buy first” question. But when you take time to weigh your finances, timeline, comfort level, and local market conditions, the decision becomes much clearer.

✨ The right choice is the one that gives you peace of mind—not just in the numbers, but in your daily life.

Categories

Recent Posts